Agile Manufacturing Strategies for Mid-Market Companies

In a rapidly changing economic and geopolitical environment, mid-market companies are under pressure like never before. Supply chain disruptions, rising costs, and financial uncertainty are testing the resilience of businesses across industries. The ability to adapt, optimize, and proactively manage risk is what separates companies that thrive from those that struggle to keep up.

To tackle these pressing issues, ExecHQ, SIB, and Shipware brought together industry leaders for a deep-dive discussion on financial resilience, cost containment, and operational efficiency. This document captures the most critical insights from that conversation—offering mid-market business leaders a practical roadmap to navigate uncertainty, strengthen their financial health, and drive long-term profitability.

Expert Insights by:

Baron Lukas, Adi Karamcheti, Eric Steele, Sean Fox, Majeed Peffley, Ellza Malok

Contributions From:

ExecHQ.com; SIB; Shipware.com

Table of Contents

Planning for Uncertainty & Financial Resilience

What can businesses do to avoid surprises and mitigate risk in this fast-paced and uncertain time?

Many companies follow a standard strategy development model but often stop at the planning phase, treating their plans as static documents. The challenge is that no plan remains intact when faced with real-world variables like tariffs, client demands, customer behavior, or supply chain disruptions.

To navigate uncertainty, businesses must adopt continuous planning—an ongoing process of assessing what is known, identifying gaps, testing assumptions, and anticipating risks. This involves consistently evaluating strengths, weaknesses, opportunities, and threats to ensure alignment with evolving conditions.

More than just having a plan, the act of planning itself is critical. This process allows businesses to stay aware of external changes, measure their adaptability, and refine their strategies. One effective approach is to establish a continuous planning team that monitors shifts in the business landscape daily. By doing so, organizations can remain agile and optimized for changing conditions, reducing surprises and mitigating risk effectively.

Are there early warning signs that a company’s financial strategy isn’t holding up?

One of the biggest warning signs isn’t just in the numbers—it’s the frequency of strategy shifts. If a company is constantly pivoting in response to market fluctuations rather than executing a structured plan, it likely lacks a solid financial foundation. For PE-backed companies, financial

What’s the right balance between cutting costs and reinvesting in growth?

Cost-cutting should be a means to enable growth, not just a reaction to financial pressure. The most effective approach is to have a clear strategic objective for any cost savings—whether that’s reinvesting in product innovation, talent acquisition, or increasing EBITDA for a future sale. Cost reductions should always be intentional and aligned with long-term business goals.

Proactive cost management is also crucial. Companies that consistently optimize expenses before they are forced to will be in the best position to reinvest in growth when market conditions shift. Businesses that operate with a lean and efficient cost structure will have a competitive advantage, while others may struggle to adapt.

What are the key steps to achieving financial resilience?

Financial resilience starts with a continuous planning process, a comprehensive CFO assessment, and strategic cost optimization. The CFO assessment identifies financial blind spots, such as inefficiencies in customer segmentation, cost allocation, or pricing strategies. Once these areas are addressed, cost reduction partners like SIB and Shipware help eliminate unnecessary spending in non-operational areas like telecom, utilities, and logistics.

With these savings secured, the focus shifts to building resilience—ensuring that financial controls are in place, reporting accurately reflects true costs, and leadership teams are aligned on financial goals. The result is not just cost savings, but a business that is maximizing profitability and positioned for long-term growth.

Cost Containment & Expense Optimization

Where Are Companies Unknowingly Losing Profitability?

One of the biggest areas of hidden inefficiency is inaccurate cost allocation. Many businesses fail to correctly assign costs to customers, products, or services, leading to misinformed pricing and operational decisions. Profit optimization analyses often reveal that companies are serving unprofitable customers or offering services at a loss without realizing it.

Another major source of hidden costs is shipping and logistics. Companies frequently assume they are managing these expenses efficiently, but detailed analysis often uncovers significant overpayments in small parcel, freight, and LTL shipping. Carrier contracts are particularly complex, and without industry benchmarking and detailed audits, many businesses miss cost-saving opportunities. Regular contract reviews are essential to ensure businesses are not overpaying for logistics services.

How does SIB help companies reduce costs without operational disruption?

SIB specializes in cost reduction across 20+ indirect spend areas without requiring service provider changes or operational disruptions. Their approach is risk-free and data-driven, leveraging a $24 billion supplier-specific benchmarking database to negotiate the best possible rates for clients.

SIB’s key advantage lies in its ability to negotiate from a position of leverage—knowing in advance what vendors have previously offered similar clients in like-for-like scenarios. Their team includes former service provider insiders who understand true vendor margins and the levers that drive negotiations, allowing for win-win cost-saving agreements.

No-Risk, Performance-Based Cost Savings

SIB operates on a shared savings model, meaning they only profit if they save their clients money. There are only two possible outcomes when working with SIB:

- The company saves money and improves margins.

- The company gets confirmation that they are already receiving best-in-class pricing.

With no upfront costs and no downside risk, companies can confidently engage SIB to identify hidden cost-saving opportunities and strengthen their financial position.

How does technology help businesses proactively manage costs?

One of the biggest challenges in cost management is lack of visibility into contracts and invoices. According to the Journal of Contract Management, 71% of companies cannot locate at least 10% of their contracts, leading to unnecessary spending. Additionally, Gartner reports that 85% of telecom invoices contain errors, and SIB’s own data shows that 35% of waste invoices have billing anomalies.

To combat this, Spendbrain—a spend management technology—enables businesses to gain full visibility into vendor contracts and spending patterns. It helps identify inefficiencies, detect billing errors, and eliminate shadow spending, ensuring companies never overpay. By integrating technology into cost management, businesses can proactively track, analyze, and optimize expenses in real time rather than reacting to financial surprises.

How does the tool itself help companies be proactive instead of reacting when managing spend and get ahead of upcoming changes from the vendors?

Spendbrain provides real-time visibility into company spending by tracking contracts, invoices, and supplier terms. It uses AI to flag discrepancies before they become significant cost leaks. If a vendor increases rates outside the agreed contract terms, Spendbrain immediately identifies the issue, allowing companies to take action before the extra costs accumulate rather than discovering them months later.

How can companies avoid a one-and-done cost-cutting mindset and build a culture of ongoing financial efficiency?

Cost-cutting should not be a one-time event but an ongoing process. Long-term cost management requires continuous tracking of contracts and invoices to catch pricing anomalies. Spendbrain ensures that agreed-upon savings are maintained by monitoring contracts for years, preventing unexpected increases.

In shipping and logistics, rate increases are common, and businesses that don’t monitor costs regularly risk falling behind market rates. Companies must actively track and challenge price increases to prevent “price creeping,” where small, incremental cost hikes accumulate into major financial losses over time. A dedicated cost-monitoring strategy ensures that savings are sustained and that companies remain competitive.

How should finance teams and operational teams collaborate with cost containment?

To avoid inefficiencies caused by corporate silos, planning and execution teams must be fully aligned. Daily team huddles between operations, finance, manufacturing, and logistics leaders help maintain focus, track progress, and ensure cost containment is an integrated process. Weekly reviews provide deeper strategic alignment, while monthly financial strategy reassessments help businesses adapt and optimize spending over time.

Finance teams play a crucial role in distinguishing strategic investments from unnecessary costs. By working closely with operations, they can ensure that cost containment efforts enhance business performance rather than hinder it. When working with external cost-reduction partners like SIB or ExecHQ, companies should see them as an extension of their internal teams, helping to accelerate cost-saving initiatives without disrupting operations.

Profit Optimization & Growth Strategies

What other ways can profit be maximized outside of cost containment and financial resilience?

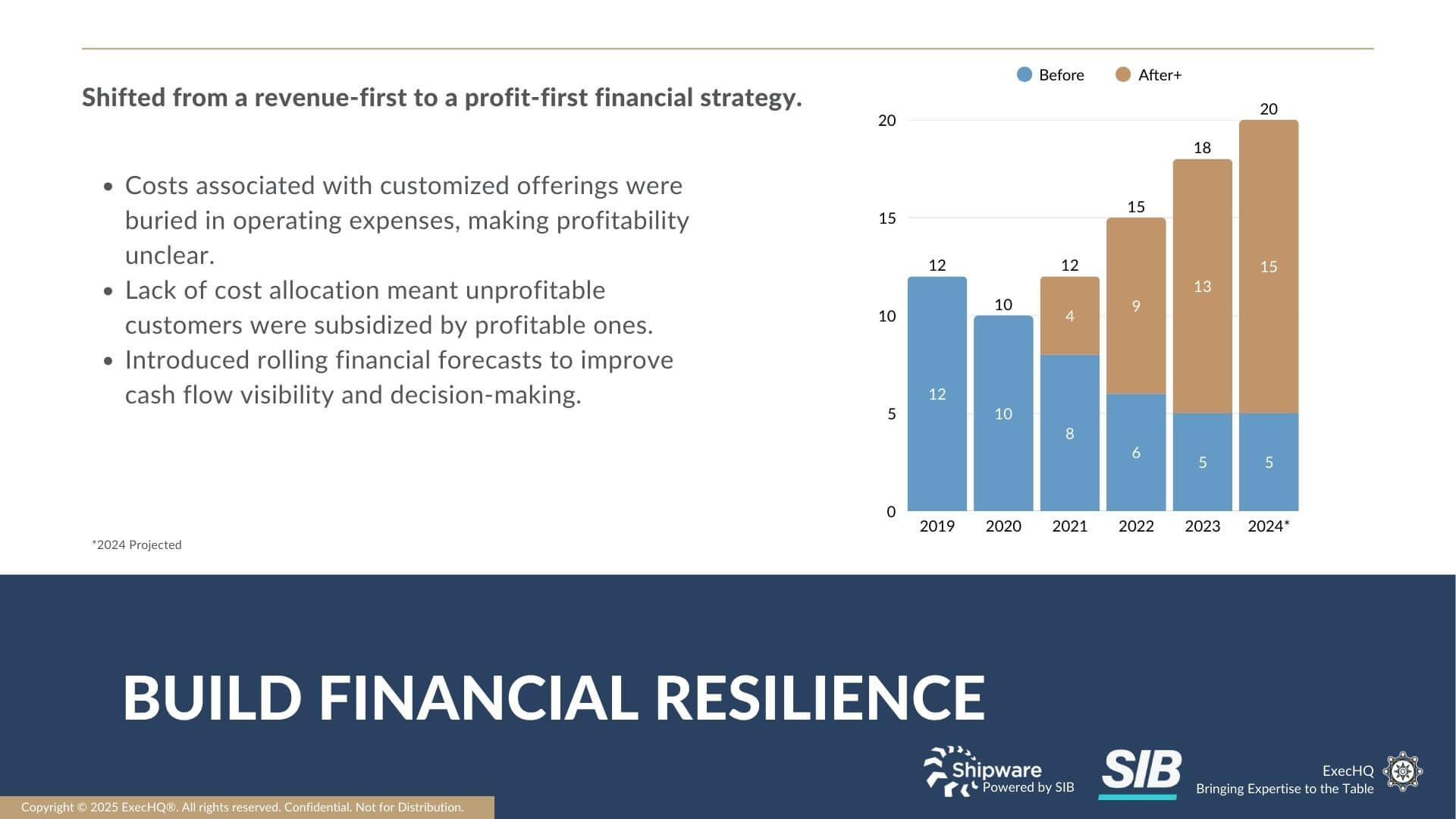

Profitability isn’t just about reducing costs—it’s about taking a systemic approach to business strategy. One critical factor is understanding customer profitability. Many companies unknowingly serve unprofitable clients, often prioritizing volume over margin. In one analysis, 41% of a company’s accounts were unprofitable, largely due to misaligned sales incentives and excessive customization practices. By adopting a profit-first strategy, companies can align their sales structures and service models with their financial objectives.

Profit optimization directly impacts enterprise value. A $3.9M profit loss due to inefficient customer management resulted in a $19M valuation drop at a 5X multiple. Businesses that prioritize long-term profitability over pure revenue growth will see greater financial resilience and higher market valuations.

So many companies focus on revenue growth, but profit optimization is where long-term success happens. Where should companies start if they want to strengthen margins?

To improve margins, companies should begin with accurate financial reporting and cost analysis. Many businesses lack proper job costing and cost-to-serve insights, which leads to pricing inefficiencies and margin erosion.

Key steps include:

- Optimizing financial reporting to reflect true operational costs.

- Evaluating customer acquisition and sales incentives to ensure profitability, not just volume, is rewarded.

- Implementing value-based pricing rather than cost-plus models, aligning prices with market demand and customer value perception.

- Conducting a Lean Six Sigma audit to identify and eliminate operational inefficiencies.

What pricing strategies can be adopted to hedge against losses while keeping long-term growth in mind?

A strong pricing strategy starts with understanding client segmentation and operational costs. If certain clients are more expensive to serve, businesses should adjust by offering tiered pricing structures. For example, clients requiring high-touch service should be positioned as premium accounts with pricing to match.

Many businesses fail to analyze customer profitability before setting prices, leading to pricing misalignment and margin leakage. To counter inflationary pressures, companies must first identify their most profitable customers and ensure their pricing reflects true cost-to-serve.

The best-performing companies reinvest savings strategically—whether to increase EBITDA, fund innovation, or expand operations. Pricing strategy isn’t just about what you charge—it’s about what you keep.

Final Takeaways

If you're an executive leader of a similar company facing these challenges, what’s the next step?

The challenges facing mid-market businesses today are complex—but they are not insurmountable. The key takeaway from this discussion is that financial resilience isn’t about reacting to change—it’s about preparing for it.

By implementing continuous planning, cost containment strategies, and financial optimization, companies can navigate uncertainty with confidence. The organizations that embrace a proactive, data-driven approach will not only survive market shifts—they will position themselves for sustainable growth and competitive advantage.

For those looking to take the next step, now is the time to evaluate your financial strategy, operational efficiency, and cost management processes—because in an uncertain world, preparation is the most valuable asset.

- Start today and gain insights tailored to your business: Contact SIB & ExecHQ